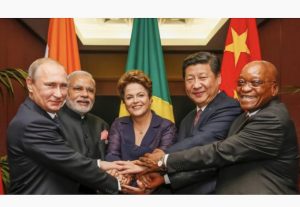

It is very important to me that New Development Bank, the bank of the BRICS, acts as the tool to support the development priorities of the BRICS and other developing countries.

We need to invest in projects that contribute to three fundamental areas:

First, we need to support the countries with regards to climate change and sustainable development goals.

Second, we should promote social inclusion at every opportunity we have.

And I believe we should finance their most critical and strategic infrastructure projects.

That said, we want to promote quality development.

Developing countries still don’t have the necessary infrastructure. They don’t have enough ports, airports, and highways to meet their needs. And many times, the ones they have are not adequate.

They still have to build alternatives and more modern models of transportation, for instance.

I see China, a country that has developed capability for alternative transportation at the scale and quality it needs.

NDB has to support the other countries to also build their quality infrastructure as well, like high-speed trains.

It is very important to invest in technology and innovation, invest in universities for example.

Our countries will not overcome extreme poverty if we don’t invest in education, science, and technology.

When asked what challenges the BRICS and NDB face, Rousseff replied:

The world now is under the threat of high inflation and restrictive monetary policy, particularly in developed countries.

Such monetary policy means a higher interest rate, and therefore a higher probability of reduction in growth and a higher probability of recession.

This presents an important question for the BRICS. We need a mechanism, a so-called anti-crisis mechanism, which must be counter-cyclical and support stabilization.

It is necessary to find ways to avoid foreign exchange risk and other issues, such as being dependent on a single currency, such as the US dollar.

The good news is that we are seeing many countries choosing to trade using their own currencies.

China and Brazil, for instance, are agreeing to exchange with RMB (renminbi) and the Brazilian real.

At the NDB, we have committed to it in our strategy. For the period from 2022 to 2026, the NDB has to lend 30% in local currencies, so 30% of our loan book will be financed in the currencies of our member countries.

That will be extremely important to help our countries avoid exchange rate risks and shortages in finance that hinder long-term investments.