DISARMAMENT & SECURITY .

Annual report by the Stockholm International Peace Research Institute

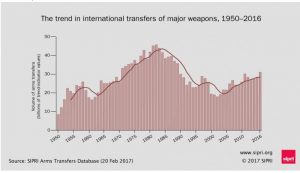

The volume of international transfers of major weapons has grown continuously since 2004 and increased by 8.4 per cent between 2007–11 and 2012–16, according to new data on arms transfers published today by the Stockholm International Peace Research Institute (SIPRI). Notably, transfers of major weapons in 2012–16 reached their highest volume for any five-year period since the end of the cold war.

(click on the image to enlarge)

The flow of arms increased to Asia and Oceania and the Middle East between 2007–11 and 2012–16, while there was a decrease in the flow to Europe, the Americas and Africa. The five biggest exporters—the United States, Russia, China, France and Germany—together accounted for 74 per cent of the total volume of arms exports.

Asia: major increases for some states

Arms imports by states in Asia and Oceania increased by 7.7 per cent between 2007–11 and 2012–16 and accounted for 43 per cent of global imports in 2012–16.

India was the world’s largest importer of major arms in 2012–16, accounting for 13 per cent of the global total. Between 2007–11 and 2012–16 it increased its arms imports by 43 per cent. In 2012–16 India’s imports were far greater than those of its regional rivals China and Pakistan.

Imports by countries in South East Asia increased 6.2 per cent from 2007–11 to 2012–16. Viet Nam made a particularly large jump from being the 29th largest importer in 2007–11 to the 10th largest in 2012–16, with arms imports increasing by 202 per cent.

‘With no regional arms control instruments in place, states in Asia continue to expand their arsenals’, said Siemon Wezeman, Senior Researcher with the SIPRI Arms and Military Expenditure Programme. ‘While China is increasingly able to substitute arms imports with indigenous products, India remains dependent on weapons technology from many willing suppliers, including Russia, the USA, European states, Israel and South Korea’.

Middle East: arms imports almost double

Between 2007–11 and 2012–16 arms imports by states in the Middle East rose by 86 per cent and accounted for 29 per cent of global imports in 2012–16.

Saudi Arabia was the world’s second largest arms importer in 2012-16, with an increase of 212 per cent compared with 2007–11. Arms imports by Qatar went up by 245 per cent. Although at lower rates, the majority of other states in the region also increased arms imports. ‘Over the past five years, most states in the Middle East have turned primarily to the USA and Europe in their accelerated pursuit of advanced military capabilities’, said Pieter Wezeman, Senior Researcher with the SIPRI Arms and Military Expenditure Programme. ‘Despite low oil prices, countries in the region continued to order more weapons in 2016, perceiving them as crucial tools for dealing with conflicts and regional tensions.’

(Article continued on the right column)

(Click here for a version of this article in French or here for a version in Spanish.)

Does military spending lead to economic decline and collapse?

(Article continued from the left column)

Arms exporters: the USA accounts for one-third of total

With a one-third share of global arms exports, the USA was the top arms exporter in 2012– 16. Its arms exports increased by 21 per cent compared with 2007–11. Almost half of its arms exports went to the Middle East.

‘The USA supplies major arms to at least 100 countries around the world—significantly more than any other supplier state’, said Dr Aude Fleurant, Director of the SIPRI Arms and Military Expenditure Programme. ‘Both advanced strike aircraft with cruise missiles and other precision-guided munitions and the latest generation air and missile defence systems account for a significant share of US arms exports.’

Russia accounted for a 23 per cent share of global exports in the period 2012–16. 70 per cent of its arms exports went to four countries: India, Viet Nam, China and Algeria.

China’s share of global arms exports rose from 3.8 to 6.2 per cent between 2007–11 and 2012–16. It is now firmly a top-tier supplier, like France and Germany which accounted for 6 per cent and 5.6 per cent, respectively. The ongoing lower rate of French arms export deliveries may end soon because of a series of major contracts signed in the past five years. Despite a spike in arms exports in 2016, German arms exports—counted over a five-year period—decreased by 36 per cent between 2007–11 and 2012–16.

Other notable developments

Algeria was the largest arms importer in Africa with 46 per cent of all imports to the region.

The largest importers in sub-Saharan Africa—Nigeria, Sudan and Ethiopia—are all in conflict zones.

Total arms imports by states in the Americas decreased by 18 per cent between 2007–11 and 2012–16. However, changes in import volumes varied considerably. Colombia’s arms imports decreased by 19 per cent, while Mexico’s arms imports grew by 184 per cent in 2012–16 compared with 2007–11.

Imports by states in Europe significantly decreased by 36 per cent between 2007–11 and 2012–16. Initial deliveries to Europe of advanced combat aircraft as part of major contracts started in 2012–16 and further deliveries will drive import volumes up in the coming years.

Imports by Azerbaijan were 20 times higher than those of Armenia in 2012–16.

For editors

The SIPRI Arms Transfers Database contains information on all international transfers of major weapons (including sales, gifts and production licences) to states, international organizations and armed non-state groups from 1950 to the most recent full calendar year, 2016. SIPRI data reflects the volume of deliveries of arms, not the financial value of the deals. As the volume of deliveries can fluctuate significantly year-onyear, SIPRI presents data for 5-year periods, giving a more stable measure of trends.

[Editor’s note: With regard to the financial value of arms transfers, SIPRi has published the following : “by adding together the data that states have made available on the financial value of their arms exports as well as estimates for those providing data on agreements or licences, it is possible to estimate that that the total value of the global arms trade in 2014 was at least $94.5 billion.* However, the actual figure is likely to be higher.”]

For information or interview requests contact Stephanie Blenckner (blenckner@sipri.org, +46 8 655 97 47) or Harri Thomas (harri.thomas@sipri.org, +46 70 972 39 50).

US arms exports are a key component of the American economy. Judging from the SIPRI information they represent somewhere between 300 and 500 billion dollars a year. That’s close to the sum of the annual American trade deficit which was $502 billion in 2016 which occurred because imports were $2.7 trillion and exports were only $2.2 trillion. Since arms exports are between 15 and 20% of total exports, they have been essential to keeping the trade deficit in check.

A similar situation pertains to the role of arms exports in the Russian economy.

We have not escaped from the economic situation of the Cold War in the 1970s and 1980s. At that time it led to the collapse of the Soviet economy. . .